Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Hello as well as welcome back to Equity, TechCrunch & s venture capital-focused podcast, where we unbox the numbers behind the headings. The entire staff was existing today: Natasha, Danny and also Alex, together with our intrepid producer Chris. And like the last few episodes it was good to have every person around as there was so very much to make it through. Even better there was a great deal of excellent, non-COVID-19 information to cover. Yes, there were poor tidings and also some COVID-19 material too, yet, hi, not everything can be fun. We began with a check out Clearbanc as well as its path extension not-a-loan program, which may aid startups endure that are running reduced on money. Natasha covered it for TechCrunch. A lot of us find out about Clearbanc & s revenue-based financing design; this is a spin. But it & s good to see firms function to adjust their products to aid various other start-ups make it through. Next we talked about a few rounds that Danny covered, particularly Sila & s $7.7 million financial investment to help construct innovation that might take on the age-old and also vulnerable ACH, and Cadence & s $4 million raising to aid with securitization. Also much better, per Danny, they are both blockchain-using business. As well as they serve! Blockchain, while you were looking elsewhere, has done some amazing stuff finally. Sticking to our fintech motif —-- the show ended up being very fintech-heavy, which was an accident —-- we resorted to SoFi & s huge $1.2 billion deal to purchase Galileo, a Utah-based repayments company that assists power a large item of UK-based fintech. SoFi is going right into the B2B fintech world after first attacking the B2C world; we reckon that if it can draw the relocation off, various other financial technology business may do the same. Tidying up all the fintech tales is this round up from Natasha and also Alex, working to figure out that in fintech is doing improperly, that & s hiding in the meantime, and also that is squashing it in the new economic fact. Next we touched on layoffs generally, discharges at Salute, AngelList, and not LinkedIn —-- for currently. Per their strategies to not have plans to have discharges. You figure that out. And afterwards at the end, we covered with great information from Thrive and also Index. We didn & t get to Shippo, sadly. Next time! Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so sign up for us on Apple Podcasts, Overcast, Spotify and also all the casts.

- Details

- Category: Technology Today

Read more: So several fintech eggs in a lot of baskets

Write comment (100 Comments)

The recent surge in coronavirus-based cybercrime has gotten so serious that security officials from the US and UK have issued a joint advisory warning that they're currently tracking over 2,500 coronavirus-themed threats.

The UK National Cyber Security Centre (NCSC) and the Department of Homeland Security (DHS) have compiled a database of malicious

- Details

- Category: Technology Today

Read more: These harmful internet sites can place your computer in jeopardy

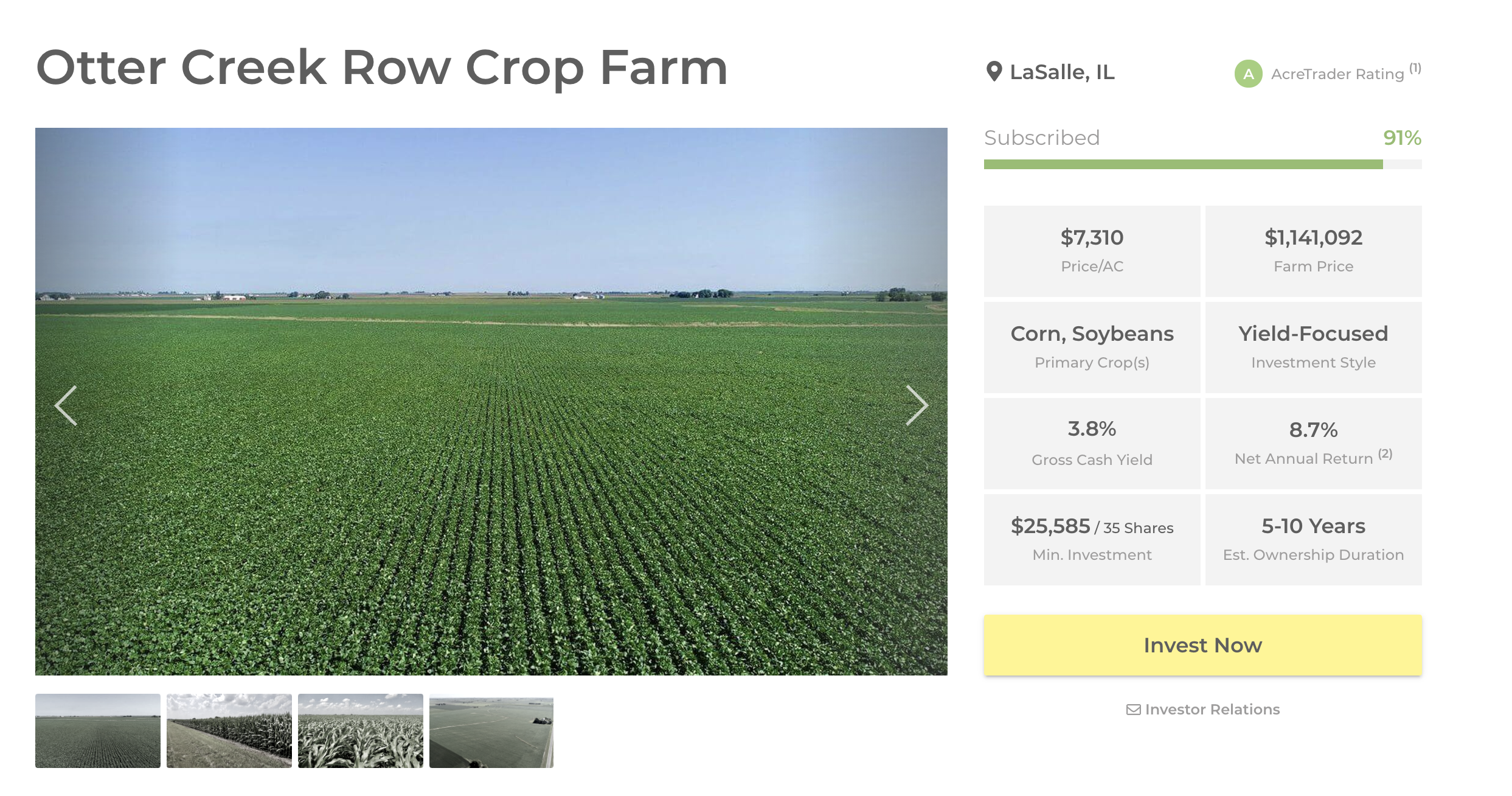

Write comment (98 Comments)Carter Malloy thinks that lucrative investments include dirt, some seeds, maintenance, and growth — literally. So, he founded Fayetteville, Arkansas-based AcreTrader, an online farmland investment platform.

AcreTrader wants to lower the barrier of farmland ownership for people who aren&t experts in investing in the field to begin with. Malloy calls it a Robinhood for buying farmland.

AcreTrader is trying to solve the traditionally cumbersome process it takes to acquire a piece of land. Historically, Malloy said, people have to acquire a piece of land which could cost millions. Land-buyers will either have deep pockets or acquire the land from family. After that, buyers have to go to a farm broker, do due diligence, and learn how to work with the farmers who will work on the land.

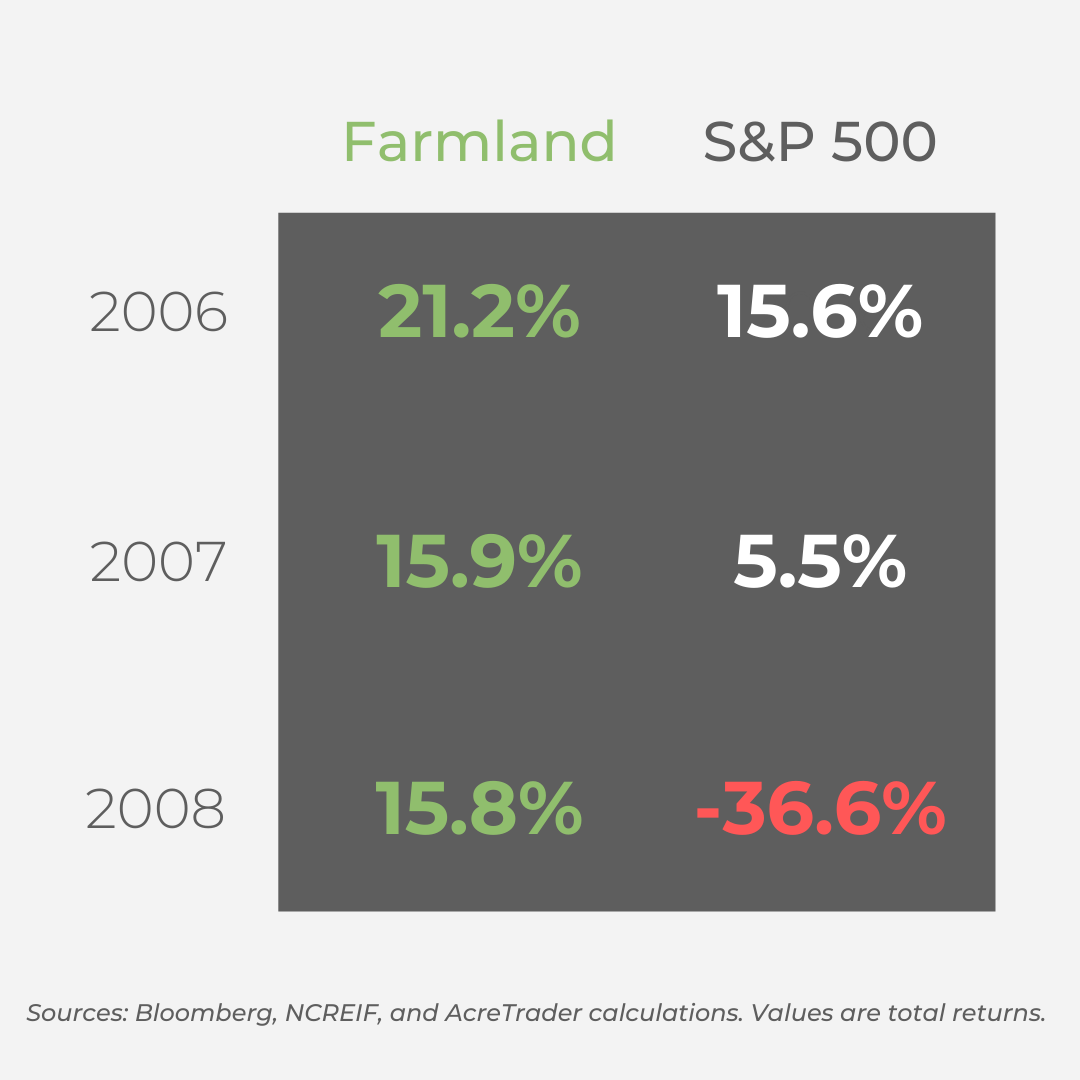

&Farmland has provided 11 to 12 percent average annual returns for nearly 30 years,& he said. &With much less volatility and price swings than other asset classes.&

The AcreTrader platform connects buyers, like individual investors, family offices, or investment funds, to farmland that is available for purchase. AcreTrader incorporates each property it acquires under an LLC, and then users are able to buy shares of that entity. Think of shares in terms of acres, so 20 shares could be 2 acres of land.

If you want to sell the shares of your land, AcreTrader has a marketplace for you to do that. But, since land has a long-term investment benefit, the company recommends holding ownership of land between 3 to 10 years, based on the property.

AcreTrader vets land properties before buying them, accounting for factors like soil quality, irrigation methods, or the history of annual crop rotation. Malloy claims the platform analyzes over 100 points of data from the farms.

The startup is currently focused on buying and selling property on the West Coast and Midwest. The farmland isn&t from the expensive rolling fields of Napa Valley, but instead &less trafficked& land, like an almond farm in Tulare, California or a soybean plain in Kankakee, Illinois.

Once a customer purchases a vetted piece of land, AcreTrader takes care of land maintenance so the onus isn&t on the buyer to learn how to grow a harvest or maintain the land. It does so through a team of dedicated farmland experts, who manage hundreds of millions of dollars of farmland and check in with farmers on a weekly basis.

&It becomes a truly passive investment,& Malloy said.

AcreTrader makes money from the real estate brokerage fees when it buys land from a seller, or in this case, a third-party farmer that pays &rent& to the company.

In December, ProducePay picked up up $190 million in debt financing for a purchase program for farmers. While the company isn&t a direct competitor of AcreTrader, it could actually operate complementary to it. ProducePay helps farmers afford the &lumpy revenues& that come with the growing season, and works as a middle man between distributors, growers and grocers.

Along with charging farmers, the company also charges an annual management fee of 0.75% to 1% to oversee land from a buyer.

AcreTrader today announced that it raised an oversubscribed $5 million seed round led by RZC investments, with participation from Revel Partners .

Malloy grew up in a farming family, and hewitnessed his father buy and sell land over the years. He said itled to him believing strongly in the consistency and risk-adjusted returns of farmland. As the world enters a time of economic uncertainty, Malloybelief in the slow and steady might echo with more people than ever before.

- Details

- Category: Technology Today

Read more: AcreTrader raises $5M to aid people buy a worthwhile property class: farmland

Write comment (90 Comments)

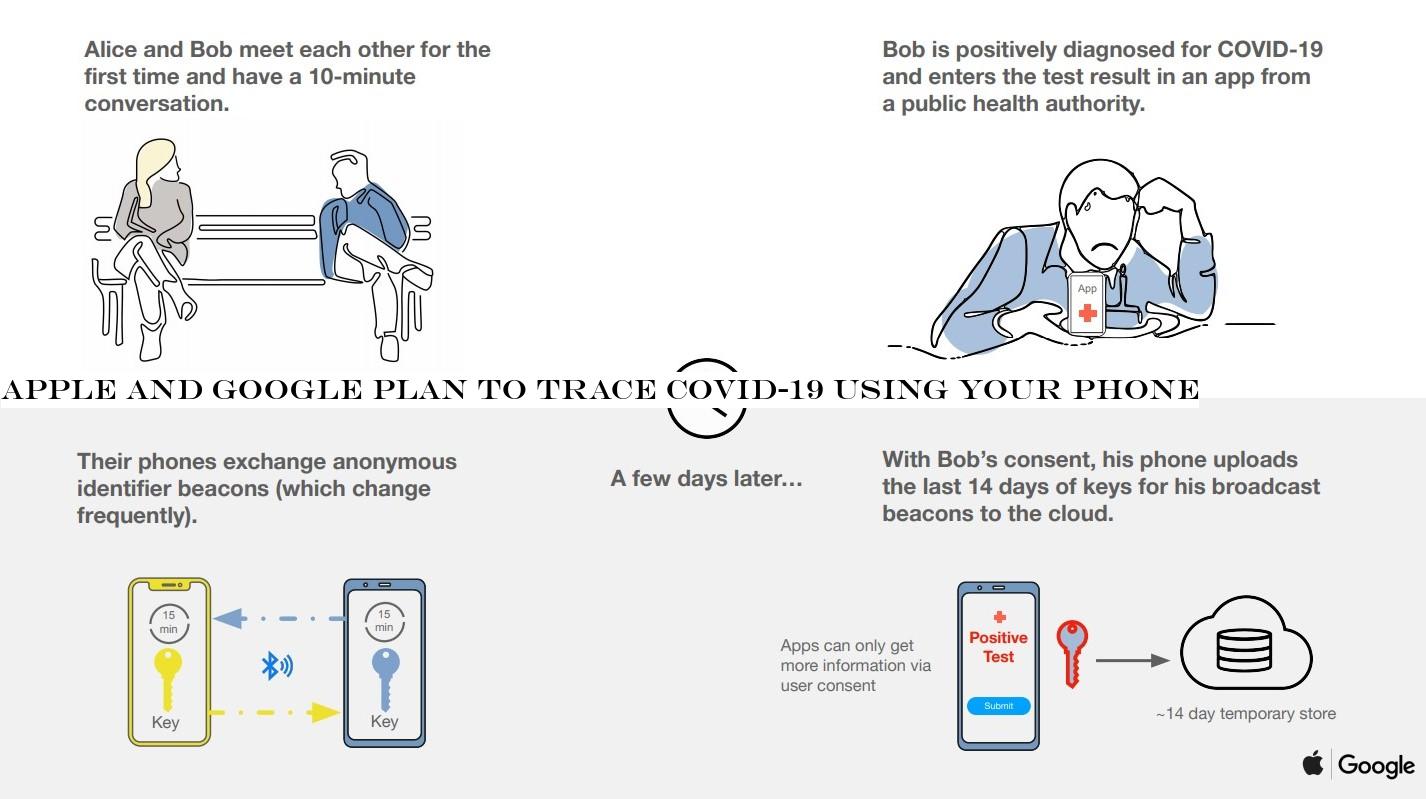

Normally bitter rivals, Apple and Google are now teaming up to create the Covid-19 contact tracing system that the world may need and staunch privacy advocates fear.

The companies' proposed solution works by tracking phones. Your smartphone will act as an anonymous identifying beacon, using Bluetooth along with the iOS and Android platforms to

- Details

- Category: Technology Today

Read more: Apple and Google prepare to trace Covid-19 utilizing your phone

Write comment (94 Comments)More than six dozen startup founders, venture capitalists and lobby groups in India have requested the government to grant them a &robust relief package& to help combat severe disruptions their businesses face due to the coronavirus outbreak.

In a joint letter to IndiaPrime Minister Narendra Modi, startups requested the government to bankroll 50% of their workforcesalaries for six months, provide interest-free loans from banks, waive rent for three months and offer tax benefits among other things.

&Unfortunately, our startup companies across the nation are inherently young, less resilient and most vulnerable. Many of them face likely devastation during this extraordinary economic downturn. At this dire moment, Indian startups need a robust relief package from the government, lest all our collective efforts of the past few years are in vain,& they wrote.

Among those who have signed the letter include Mohit Bhatnagar, a managing director at Sequoia Capital, which is in advanced stages to close a fresh $1.3 billion fund for India and Southeast Asia, Gaurav Agarwal of online medicine store 1mg, Debjani Ghosh of industry body Nasscom, Karthik Reddy of Blume Ventures, Anand Lunia of India Quotient, Deepinder Goyal of Zomato, and Sriharsha Majety of Swiggy.

Some prominent startup founders and VCs including Vijay Shekhar Sharma of Paytm, and Ritesh Agarwal of Oyo, have also held a meeting with Piyush Goyal, the commerce minister in India, for a similar relief.

&We seek your urgent intervention to help ensure Indiastartup ecosystem survives this crisis to emerge as a pillar of growth, employment and innovation to help drive Indiarecovery. We need the startup ecosystem to survive in order to help the economy bounce back. We have enclosed herewith our submission for your kind consideration and we look forward to your support in this regard,& the joint letter reads.

The request for bailout comes amid a national lockdown in India that has disrupted countless businesses. New Delhi ordered a 21-day lockdown last month in a bid to curtail the spread of Covid-19.

Earlier this month, ten prominent VC and PE funds in India cautioned startups to brace for the &worst& months ahead.

&Assumptions from bull market financings or even from a few weeks ago do not apply. Many investors will move away from thinking about ‘growth at all costs& to ‘reasonable growth with a path to profitability.& Adjust your business plan and messaging accordingly,& they said.

As India, where the economy growth has been slowing for several quarters, scrambles to provide for its 1.3 billion citizens, the letter has drawn some criticism from industry figures.

&I can&t fathom how such a list gets made in a country of more than a billion people who are facing a crisis unlike any they&ve seen before. A significant majority of them daily wage earners who have no financial cushion or any idea where their next meal is going to come from. Letnot even stray into health and the need for medical emergencies; just putting three square meals on the table a day is proving to be impossible for so many,& wrote Ashish K. Mishra in a column on The Morning Context.

&At this very moment, it is they who need the governmentsupport. Not fat cats with bloated, middling business models and venture capital funds whose begging bowls are now seemingly larger than their risk appetite,& he added.

Companies asking for a bailout is not limited to India. Oil giants have sought similar help from the U.S. President Donald Trump — and VCs and startups are beginning to explore their option. Brent Hoberman, chairman and co-founder of Founders Factory and Firstminute Capital, urged the UK government to provide some relief to startups last month. But the government has yet to do much about it, just askDeliveroo, Graphcore and other big UK startups.

- Details

- Category: Technology Today

With schools closed for the foreseeable future, teachers have valiantly turned to a variety of video conferencing platforms to deliver ongoing education, but many face technical hurdles using platforms that were never designed with their needs in mind. They continue to do their best and we’re seeing them heroically persevere.

Remote teaching

We’ve a

- Details

- Category: Technology Today

Read more: Just exactly how to make online tuition advantage students

Write comment (91 Comments)

13

13