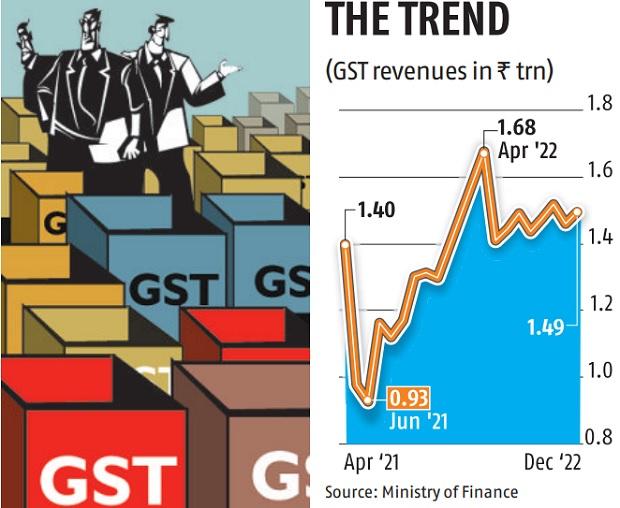

Gross goods and services tax (GST) collection for December phoned over Rs 1.49 trillion, the information launched by the financing ministry showed.This is a rise of 15 percent year-on-year, primarily driven by increase in list prices of consumption products, high inflation, and action taken to make sure compliance.This was the third-highest monthly collection considering that the tax was presented in July 2017.

GST collection touched a record high of Rs 1.68 trillion in April and touched over Rs 1.51 trillion in October.

This is the tenth month in a row-- that month-to-month GST income has been more than Rs 1.4 trillion, the ministry said on Sunday while launching the information.If the pattern continues, general GST collection may surpass the budgetary price quote by Rs 1.3-1.4 trillion, experts estimate.The Budget 2022 set the Central GST (CGST) target at Rs 6.6 trillion, excluding the settlement cess.

Between April and December, CGST collection stood at more than Rs 5.5 trillion.

The headline GST numbers remain robust.

Income from domestic deals might continue to report greater growth than that from imports, provided the moderation in commodity prices, said Aditi Nayar, chief economic expert, ICRA.During the month, revenues from imports of goods were 8 percent higher and those from domestic transactions (consisting of imports of services) were 18 percent higher than those from these sources throughout the very same month last year, the ministry stated.In November 2022, 79 million e-way costs were created as versus 76 million in October.The most recent GST numbers pertain to the transactions made in November.

An 18 percent boost in GST profits from domestic deals, viewed with the expansion in e-way costs issuance and the substantial boost in GST collection by crucial producer and consuming states, would suggest a sustained manufacturing and usage cycle throughout recent months, stated M S Mani, partner, Deloitte India.Of the mop-up in December, central CGST was Rs 26,711 crore, State GST Rs 33,357 crore, integrated GST Rs 78,434 crore (including Rs 40,263 crore collected on imports of goods), and cess Rs 11,005 crore (including Rs 850 crore collected on imports of goods), the data revealed.The government has actually settled Rs 36,669 crore to CGST and Rs 31,094 crore to SGST from IGST as routine settlement.After regular settlements, the incomes of the Centre and the states stood at Rs 63,380 crore as CGST and Rs 64,451 crore as SGST.

The stable boost in GST collection over current months, while being reflective of manufacturing and intake stability across states, would also tie in with essential macro economic indications, which have been indicating a good financial performance across key sectors, Mani added.

5

5