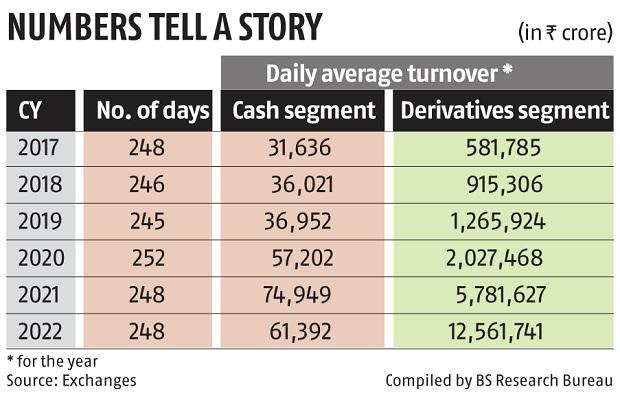

Cashtrading volume decreased in 2022, even as benchmark indices surpassed their peers.

The average everyday trading volume (ADTV) for the money sector fell 18 percent year-on-year to Rs 61,392 crore (NSE and BSE integrated).The ADTV for the futures and options (F&O) segment (NSE and BSE integrated) stood at Rs 125 trillion (notional turnover), up 117 percent from the previous year.Experts said that though the Indian markets outshined peers, the gains were not significant for retail financiers who primarily meddle cashtrading.

In 2022, the Sensex increased by 4.4 per cent and the Nifty50 by 4.3 percent.

A 4 percent gain was not considerable for retail investors to generate income.

When retail is not making money, participation reduces.

There is also some fatigue after the jump in Demat accounts and exceptional returns in the preceding two years.

Volatility helps traders.

For financiers what assists is the gain in the stock.

Volatility does not help cash investors, at all.

For financiers, it is the long-term rally that helps, stated Prakarsh Gagdani, CEO of 5paisa Capital.The gains in the broader markets were even less.

The BSE Midcap increased 1.4 per cent and the BSE SmallCap fell 1.8 percent.

If you take a look at mid- and small-caps, they have fixed substantially.

A lot of activity and volumes occur in mid- and small-caps.

There was a significant correction and many customers faded out.

The share of delivery is likewise boiling down.

Whatever cash volume is there, the proportion of intraday volume is increasing.

In 2022, there was no clear pattern noticeable in the market, so people dabbled in short-term speculation, said Dhiraj Relli, managing director, HDFC Securities.Relli said there were some movements of capital from equities to financial obligation in the latter part of last year.

Cash volume is likely to stay soft this year, too.

The upside opportunity in broad indices after exceeding the majority of the marketplaces is limited.

The majority of the brokerages have actually given a target of 19,000-20,500, which means about a 10 per cent upside from the existing level.

With limited upside presence in equities and the possibility of appealing risk-free return in debt, some money will move there.

And people are playing the volatility through derivatives.

There may not be a significant correction and money volume will remain low, added Relli.

20

20