India last week proposed a lower-than-expected market borrowing program, as part of a strategy that looked for to bridge its deficit spending by improving reliance on the nations small cost savings swimming pool.The decision on Feb.

1 triggered the most significant drop in the criteria 10-year bond yields in over two months.

Bonds have because pared their gains, with the budget mathematics increasingly looking challenging as industrial rates of interest soar tracking a tight monetary policy.The government promised to shrink its spending plan gap to 5.9% of gdp in the year beginning April 1 from 6.4% this year.

While Prime Minister Narendra Modis administration has kept the reliance on market loanings to bridge the deficiency nearly the same, it plans to increase the share of small cost savings because equation to more than 26% next fiscal year from 24% currently.The federal government funds its fiscal deficit through a mix of loanings from the bond market, follows small savings and draw down from money balance.

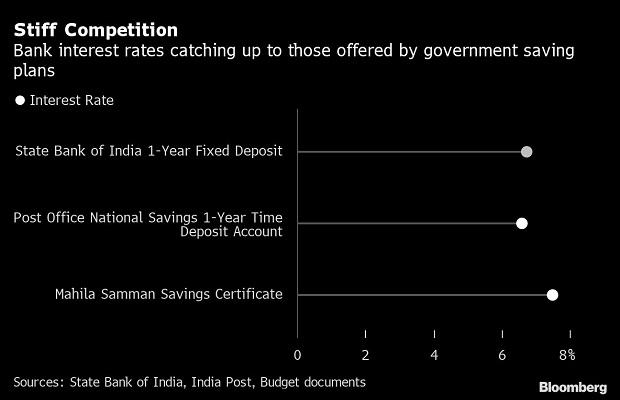

Restricting bond sales helps the government keep a lid on loaning expenses.But with industrial interest rates rising after 250 basis points of monetary tightening up by the Reserve Bank of India, it might find tapping small savings hard as depositors are more likely to park their monies in appealing bank repaired deposits than government-backed savings schemes, where rate changes tend to happen with a lag.Collections through National Small Savings Fund in the present year saw around 9.5% drop, according to a report by Emkay Global Financial Services Ltd.

That makes the governments quote for the little cost savings fund to grow over 7% to 4.7 trillion rupees in the new a bit optimistic.

It requires to be seen if small cost savings fund, which has actually benefited from the monetary rewards holds up as expected, with bank savings rates turning attractive, states Madhavi Arora, lead economic expert at Emkay Global.The government has treked the rates on most of the offerings under its smalls cost savings fund for the January-March quarter by 20 to 110 basis points, with the plan for senior people fetching as much as 8% in returns, Indian banks have also been playing capture up by increasing loaning and deposit rates in consonance with the policy rate.Professionals believe Indian banks might continue to trek deposit rates to further align it with the RBIs repurchase-rate of 6.50%, which might offer a stiff competitors to the governments intent to enhance collections under the NSSF.

The little savings math is a bit confusing as real inflows into small savings schemes are running lower, Prasanna Ananthasubramanian, primary economist at ICICI Securities Primary Dealership Ltd.

wrote in a note.

We now envisage a stiff competition for deposits between banks and government plans.

Acknowledging the possibility that collections from little savings might fall short in fiscal year ending March 2023, Finance Secretary TV Somanathan said in an interview that Treasury-bills together with state federal government funds and external borrowings are levers that could be utilized to bridge the space in case of that eventuality.To be sure, the Indian government is relying on better rates on little cost savings and a brand-new program for ladies to assist draw in savers.

If not, it constantly has the alternative to raise short-term loanings to tide over any short-lived cash inequality for next financial.

In the present fiscal year, the federal government increased loanings through T-bills by 500 billion rupees while maintaining predictability for dated securities.

6

6