Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Would you pay with a &Google Card?& TechCrunch has obtained imagery that shows Google is developing its own physical and virtual debit cards. The Google card and associated checking account will allow users to buy things with a card, mobile phone or online. It connects to a Google app with new features that let users easily monitor purchases, check their balance or lock their account. The card will be co-branded with different bank partners, including CITI and Stanford Federal Credit Union.

A source provided TechCrunch with the images seen here, as well as proof that they came from Google. Another source confirmed that Google has recently worked on a payments card that its team hopes will become the foundation of its Google Pay app — and help it rival Apple Pay and the Apple Card. Currently, Google Pay only allows online and peer-to-peer payments by connecting a traditionally issued payment card. A &Google Pay Card& would vastly expand the appuse cases, and Googlepotential as a fintech giant.

Google the financial services company?

By building a smart debit card, Google has the opportunity to unlock new streams of revenue and data. It could potentially charge interchange fees on purchases made with the card or other checking account fees, and then split them with its banking partners. Depending on its privacy decisions, Google could use transaction data on what people buy to improve ad campaign measurement or even targeting. Brands might be willing to buy more Google ads if the tech giant can prove they drive a sales lift.

The long-term implications are even greater. While once the industry joke was that every app eventually becomes a messaging app, more recently itbeen that every tech company eventually becomes a financial services company. A smart debit card and checking accounts could pave the way for Google offering banking, stock brokerage, financial advice or robo-advising, accounting, insurance or lending.

Image Credits: jossnatu / Getty Images

Googlevast access to data could allow it to more accurately manage risk than traditional financial institutions. Its deep connection to consumers via apps, ads, search and the Android operating system gives it ample ways to promote and integrate financial services. With the COVID-19 downturn taking shape, high-margin finance products could help Google develop efficient revenue opportunities and build its share price back up.

When TechCrunch asked Google for confirmation, it did not dispute our findings or assertions. The company offered us a statement it provided reporters following a November story, wherein Google told The Wall Street Journal it was experimenting in the checking account space. TechCrunch is the first to report Googledebit card plans:

We&re exploring how we can partner with banks and credit unions in the US to offer smart checking accounts through Google Pay, helping their customers benefit from useful insights and budgeting tools, while keeping their money in an FDIC or NCUA-insured account. Our lead partners today are Citi and Stanford Federal Credit Union, and we look forward to sharing more details in the coming months.

For now, Googlestrategy is to let partnered banks and credit unions provide the underlying financial infrastructure and navigate regulation while it builds smarter interfaces and user experiences. Itforseeable that one day Google might cut out the banks and take all the spoils for itself. Google launched a Wallet debit card in 2013 as an extension of its old payment app Google Wallet, but shut the card down in 2016. Given Googlepenchant for renaming or shutting down then reviving products, building a new debit card feels on-brand.

With people around the world suddenly more concerned about their finances amidst the coronavirus economic disaster, a debit card with more transparency and controls could be appealing.

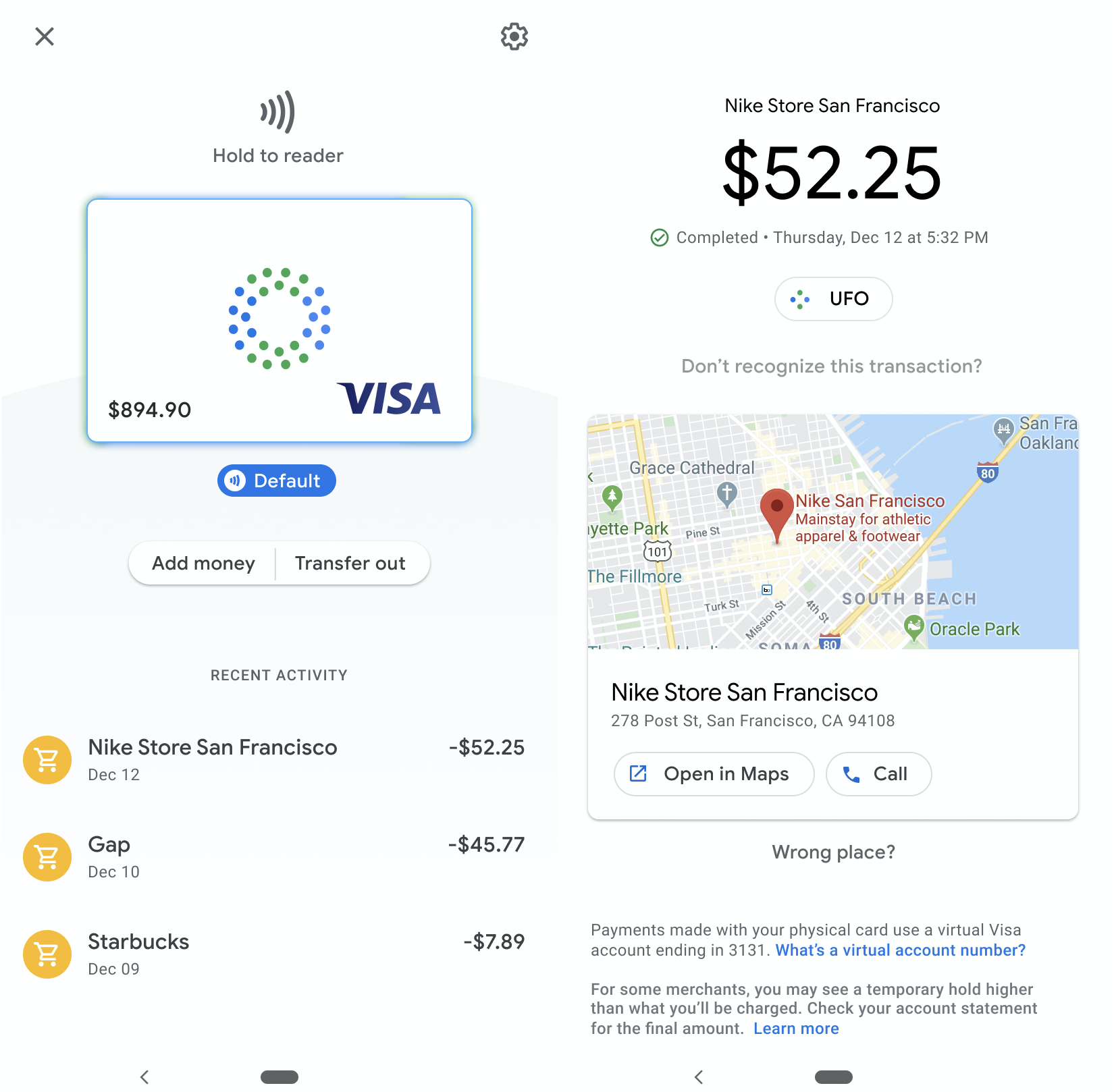

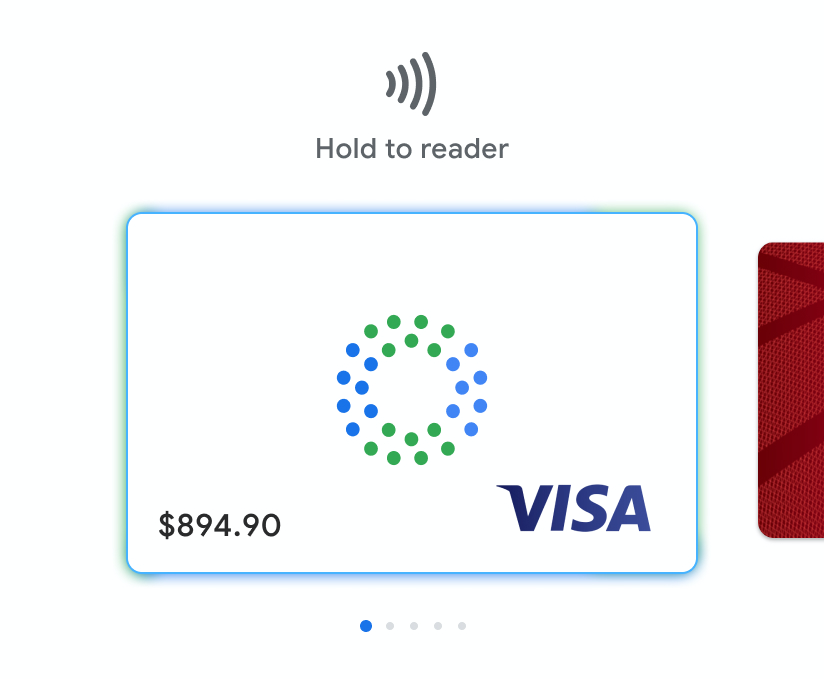

First look at the Google Card

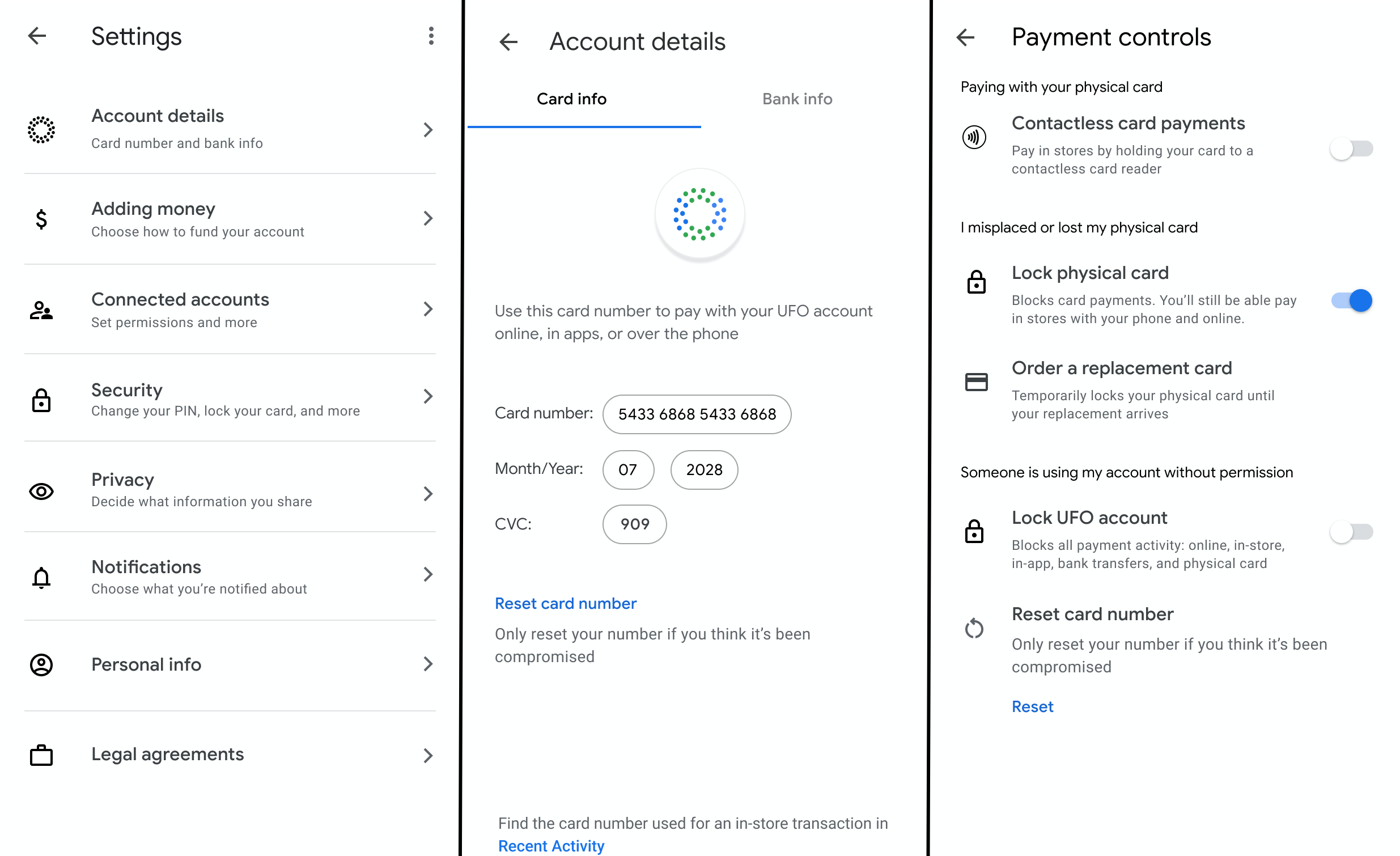

Traditional banking products can be clunky, often requiring phone communication with customer service or sifting through cluttered websites to address security issues. Google hopes to make financial management as intuitive as its email and mapping apps. The card and app designs shown here are not final, and itunclear when Googledebit card may launch. But lettake a look at what these internal Google materials reveal about its ambitions for its payment instrument.

The Google debit card will come co-branded with the Google name and its partnered bank, though the exact name of the product is still unknown. In the designs, ita chip card on the Visa network, though Google could potentially support other networks like Mastercard. Users are able to add money or transfer funds out of their account from the connected Google app, which is likely to be Google Pay, and use a fingerprint and PIN for account security.

Once connected to their bank or credit union account, users could pay for purchases in retail stores with a physical Google debit card, including with contactless payments, by just holding it up to a card reader. A virtual version of the card that lives on a userphone can also be used for Bluetooth mobile payments. Meanwhile, a virtual card number can be used for online or in-app payments.

Users are shown a list of recent transactions, with each including the merchant name, date and price. They can dig into each transaction to see the location on a map, get directions or call the store. If users don&t recognize a transaction, iteasy to protect themselves with the cardvast security options.

If a customer suspects foul play because they lost their card, they can lock it and optionally order a replacement while still being able to pay with their phone or online, thanks to Googlevirtual card number system thatdifferent than the one on their physical card. If instead they suspect their virtual card number was stolen by a hacker, they can quickly reset it. And if they believe someone has gained unauthorized access to their account, they can lock it entirely to block all types of payments and transfers.

The settings reveal options for notifications and privacy controls to &decide what information you share,& though we don&t have imagery of whatcontained in those menus. Itunclear how much power Google will give customers to limit the company or merchantdata access. Googledecisions there could impact how transaction data might fuel its other businesses.

Fintech everywhere

Google is a relative late-comer to offering its own card. Apple launched its Apple Card in August, offering a slickly designed titanium Mastercard credit card backed by Goldman Sachs. It charges minimal customer fees, comes with a virtual card for use through Apple Pay and generates interest.

Apple Card

Apple does collect interchange fees from merchants, though, which Google could similarly gather to earn revenue. Last month, Apple changed the Cardprivacy settings to share more data with Goldman Sachs that might also help the two provide additional financial services. Apple Pay now accounts for 5% of global card transactions, and is forecast to hit 10% by 2024, according to Bernstein research. The underlines the gigantic market Google is gunning for here.

The stock brokerage and robo-advisor apps have also joined the payments race. Wealthfront launched cash accounts and debit cards last February, bringing in $1 billion in assets in two months and doubling the companytotal holdings to $20 billion by September. Betterment launched its checking product in October 2019 with a Visa debit card, but it doesn&t generate interest.

Robinhood botched the December 2018 launch of its checking accounts due to ineligible insurance, but relaunched in October 2019 with debit card withdrawls from 75,000 ATMs and a solid interest rate. Itunclear how Googlecard will work with ATMs or how its checking accounts will generate interest.

Robinhooddebit cards

The appeal for Google and the rest is clear. It seems whenever companies help move peoplemoney around, some of it inevitably &falls off the truck& and lands in their pockets. Financial services are typically low-overhead ways to generate revenue. That could be especially enticing, as Google has found many of its side hustle &other bets& to be unsustainable. Itmoved to prune some of these tertiary projects, such as its Makani wind energy kites.

Google may never find businesses as lucrative as its core in search and advertising, but it has the advantages to become a serious player in fintech. Its vast sums of cash, deep bench of engineering talent, experience building complex utilities, numerous consumer touch points and near-bottomless well of data could give it an edge over stodgier old banks and scrappier startups. And while Facebook slams into regulatory scrutiny and is forced to scale back its Libra cryptocurrency, Googlemore familiar approach via debit cards could pay off.

- Details

- Category: Technology Today

Read more: Dripped images reveal Google smart debit card to rival Apple's

Write comment (100 Comments)The Europas Awards for European Tech Startups is doing what everyone in tech has done before: pivoting! Given the COVID-19 pandemic, we will be ‘going virtual& on an amazing new platform, to be unveiled. (OK, but not VR & just yet!). A percentage of proceeds from the event will be donated to charities across Europe helping to fight the pandemic.

Judging will be entirely virtual and the Awards themselves will be announced live on 25th June at an online event which will feature special guests, and live entertainment — so we can party!. All long-listed companies in the PeopleVote will be showcased on TechCrunch.

Of key interest to startups short-listed in the awards will be the opportunity to attend over 20 workshops built around the awards categories, to which investors will be invited. That20+hours of programming. Shortlisted companies will be able to pitch live on the platform, with slides. IN addition the &Pathfounder Sessions& will offer exclusive workshops with specially invited guests, aimed at European startups raising money at this time.

If you&d like to talk about sponsoring, please contact Claire Dobson on This email address is being protected from spambots. You need JavaScript enabled to view it.. Sponsors will be able to attend and participate in workshops.

The application form to enter is here.

NEW CLOSING DATE FOR APPLICATIONS: 24 April 2020

Our new platform will even allow everyone to network virtually and easily exchange contact details, just as you would at a real-world event.

Our virtual attendees will be limited to only 500 people, and will include only Investors, Founders and Senior Executives of mid to late-stage companies as well as some of the newest companies on the scene.

The Europas is always attended by journalists from major tech titles, newspapers and business broadcasters, and will still be.

The initial long-list will draw from late-stage seed and Series A companies tackling these ambitious goals with proven product-market fit and growing traction who have been carefully scouted and invited to apply.

We are delighted to unveil our judges for the awards, listed below.

The Awards — which have been running for over 10 years — will be live held on the evening of 25 June 2020 from the London time zone.

TechCrunch is once more the exclusive media sponsor of the awards and conference, alongside The Pathfounder.

We&re scouting for the top late-stage seed and Series A startups in 23 categories. After a decade of identifying the most innovative tech startups in Europe including Spotify, Transferwise, Soundcloud, and Babylon Health, The Europas has shown itself capable of finding Europehottest startups. The Europas Awards have been going for the last 10 years, and we&re the only independent and editorially driven event to recognise the European tech startup scene. The winners have been featured in Reuters, Bloomberg, VentureBeat, Forbes, Tech.eu, The Memo, Smart Company, CNET, many others — and of course, TechCrunch.

You can nominate a startup, accelerator or venture investor that you think deserves to be recognized for their achievements in the last 12 months. This year we are particularly looking at startups that are able to address the SDGs/Globals Goals.

Timeline of The Europas Awards deadlines:

24 April___________Final deadline to submit applications 27 April___________All startups notified of longlist 04 May_____________Public voting begins 17 May_____________Public voting ends 25 May_____________Shortlist announced 26 May & 16 June___Awards Category Deep Dives + Pitches 17- 23 June________Pathfounder Workshops 25 June____________Winners announced / Virtual Awards

The Pathfounder Workshops Prior to the awards we will be holding special, premium content events The Pathfounder, designed be a &fast download& into the European tech scene for founders looking to raise money or enhance their business. This will be followed by the awards!

The Europas &Diversity Pass& We&d like to encourage more diversity in tech! Thatwhy we&ve set aside a block of free tickets to ensure that pre-seed female and BAME founders are represented at The Europas. This limited tranche of free tickets ensures that we include more women and people of colour who are specifically &pre-seed& or &seed-stage& tech startup founders. If you are a women/BAME founder, apply here for a chance to be considered for one of the limited free diversity passes to the event.

Lastly, remember: stay home, stay safe!

Meet our speakers and judges:

Anne Boden

CEO

Starling Bank

Anne Boden is founder and CEO of Starling Bank, a fast-growing U.K. digital bank targeting millions of users who live their lives on their phones. After a distinguished career in senior leadership at some of the worldbest-known financial heavyweights, she set out to build her own mobile bank from scratch in 2014. Today, Starling has opened more than one million current accounts for individuals and small businesses and raised hundreds of millions of pounds in backing. Anne was awarded an MBE for services to financial technology in 2018.

Anne Boden

CEO

Starling Bank

Anne Boden is founder and CEO of Starling Bank, a fast-growing U.K. digital bank targeting millions of users who live their lives on their phones. After a distinguished career in senior leadership at some of the worldbest-known financial heavyweights, she set out to build her own mobile bank from scratch in 2014. Today, Starling has opened more than one million current accounts for individuals and small businesses and raised hundreds of millions of pounds in backing. Anne was awarded an MBE for services to financial technology in 2018.

Bernhard Niesner

CEO and c-founder

busuu

Bernhard co-founded busuu in 2008 following an MBA project and has since led the company to become the worldlargest community for language learning, with more than 90 million users across the globe. Before starting busuu, Bernhard worked as a consultant at Roland Berger Strategy Consultants. He graduated summa cum laude in International Business from the Vienna University of Economics and Business and holds an MBA with honours from IE Business School. Bernhard is an active mentor and business angel in the startup community and an advisor to the Austrian Government on education affairs. Bernhard recently received the EY Entrepreneur of the Year 2018 UK Awards in the Disruptor category.

Bernhard Niesner

CEO and c-founder

busuu

Bernhard co-founded busuu in 2008 following an MBA project and has since led the company to become the worldlargest community for language learning, with more than 90 million users across the globe. Before starting busuu, Bernhard worked as a consultant at Roland Berger Strategy Consultants. He graduated summa cum laude in International Business from the Vienna University of Economics and Business and holds an MBA with honours from IE Business School. Bernhard is an active mentor and business angel in the startup community and an advisor to the Austrian Government on education affairs. Bernhard recently received the EY Entrepreneur of the Year 2018 UK Awards in the Disruptor category.

Chris Morton

CEO and founder

Lyst

Chris is the founder and CEO of Lyst, the worldbiggest fashion search platform used by 104 million shoppers each year. Including over 6 million products from brands including Burberry, Fendi, Gucci, Prada and Saint Laurent, Lyst offers shoppers convenience and unparalleled choice in one place. Launched in London in 2010, Lystinvestors include LVMH, 14W, Balderton and Accel Partners. Prior to founding Lyst, Chris was an investor at Benchmark Capital and Balderton Capital in London, focusing on the early-stage consumer internet space. He holds an MA in physics and philosophy from Cambridge University.

Chris Morton

CEO and founder

Lyst

Chris is the founder and CEO of Lyst, the worldbiggest fashion search platform used by 104 million shoppers each year. Including over 6 million products from brands including Burberry, Fendi, Gucci, Prada and Saint Laurent, Lyst offers shoppers convenience and unparalleled choice in one place. Launched in London in 2010, Lystinvestors include LVMH, 14W, Balderton and Accel Partners. Prior to founding Lyst, Chris was an investor at Benchmark Capital and Balderton Capital in London, focusing on the early-stage consumer internet space. He holds an MA in physics and philosophy from Cambridge University.

Clare Jones

Chief Commercial Officer

what3words

Clare is the chief commercial officer of what3words; prior to this, her background was in the development and growth of social enterprises and in impact investment. Clare was featured in the 2019 Forbes 30 under 30 list for technology and is involved with London companies tackling social/environmental challenges. Clare also volunteers with the Streetlink project, doing health outreach work with vulnerable women in South London.

Clare Jones

Chief Commercial Officer

what3words

Clare is the chief commercial officer of what3words; prior to this, her background was in the development and growth of social enterprises and in impact investment. Clare was featured in the 2019 Forbes 30 under 30 list for technology and is involved with London companies tackling social/environmental challenges. Clare also volunteers with the Streetlink project, doing health outreach work with vulnerable women in South London.

Husayn Kassai

CEO and co-founder

Onfido

Husayn Kassai is the Onfido CEO and co-founder. Onfido helps businesses digitally onboard users by verifying any government ID and comparing it with the personfacial biometrics. Founded in 2012, Onfido has grown to a team of 300 across SF, NYC and London; received over $100 million in funding from Salesforce, Microsoft and others; and works with over 1,500 fintech, banking and marketplace clients globally. Husayn is a WEF Tech Pioneer; a Forbes Contributor; and Forbes& &30 Under 30&. He has a BA in economics and management from Keble College, Oxford.

Husayn Kassai

CEO and co-founder

Onfido

Husayn Kassai is the Onfido CEO and co-founder. Onfido helps businesses digitally onboard users by verifying any government ID and comparing it with the personfacial biometrics. Founded in 2012, Onfido has grown to a team of 300 across SF, NYC and London; received over $100 million in funding from Salesforce, Microsoft and others; and works with over 1,500 fintech, banking and marketplace clients globally. Husayn is a WEF Tech Pioneer; a Forbes Contributor; and Forbes& &30 Under 30&. He has a BA in economics and management from Keble College, Oxford.

Kieran O&Neill

CEO and co-founder

Thread

Thread makes it easy for guys to dress well. They combine expert stylists with powerful AI to recommend the perfect clothes for each person. Thread is used by more than 1 million men in the U.K., and has raised $35 million from top investors, including Balderton Capital, the founders of DeepMind and the billionaire former owner of Warner Music. Prior to Thread, Kieran founded one of the first video sharing websites at age 15 and sold it for $1.25 million at age 19. He was then CEO and co-founder of Playfire, the largest social network for gamers, which he grew to 1.5 million customers before being acquired in 2012. Hea member of the Forbes, Drapers and Financial Times 30 Under 30 lists.

Kieran O&Neill

CEO and co-founder

Thread

Thread makes it easy for guys to dress well. They combine expert stylists with powerful AI to recommend the perfect clothes for each person. Thread is used by more than 1 million men in the U.K., and has raised $35 million from top investors, including Balderton Capital, the founders of DeepMind and the billionaire former owner of Warner Music. Prior to Thread, Kieran founded one of the first video sharing websites at age 15 and sold it for $1.25 million at age 19. He was then CEO and co-founder of Playfire, the largest social network for gamers, which he grew to 1.5 million customers before being acquired in 2012. Hea member of the Forbes, Drapers and Financial Times 30 Under 30 lists.

Luca Bocchio

Principal

Accel

Luca Bocchio joined Accel in 2018 and focuses on consumer internet, fintech and software businesses. Luca led Accelinvestment in Luko, Bryter and Brumbrum. Luca also helped lead Accelinvestment and ongoing work in Sennder. Prior to Accel, Luca was with H14, where he invested in global early and growth-stage opportunities, such as Deliveroo, GetYourGuide, Flixbus, SumUp and SecretEscapes. Luca previously advised technology, industrial and consumer companies on strategy with Bain - Co. in Europe and Asia. Luca is from Italy and graduated from LIUC University.

Luca Bocchio

Principal

Accel

Luca Bocchio joined Accel in 2018 and focuses on consumer internet, fintech and software businesses. Luca led Accelinvestment in Luko, Bryter and Brumbrum. Luca also helped lead Accelinvestment and ongoing work in Sennder. Prior to Accel, Luca was with H14, where he invested in global early and growth-stage opportunities, such as Deliveroo, GetYourGuide, Flixbus, SumUp and SecretEscapes. Luca previously advised technology, industrial and consumer companies on strategy with Bain - Co. in Europe and Asia. Luca is from Italy and graduated from LIUC University.

Nate Lanxon (Speaker)

Editor and Tech Correspondent

Bloomberg

Nate is an editor and tech correspondent for Bloomberg, based in London. For over a decade, he has particularly focused on the consumer technology sector, and the trends shaping the global industry. Previous to this, he was senior editor at Bloomberg Media and was head of digital editorial for Bloomberg.com in Europe, the Middle East and Africa. Nate has held numerous roles across the most respected titles in tech, including stints as editor of WIRED.co.uk, editor-in-chief of Ars Technica UK and senior editor at CBS-owned CNET. Nate launched his professional career as a journalist by founding a small tech and gaming website called TechMessage, which is now the name of his weekly technology podcast hosted at natelanxon.com.

Nate Lanxon (Speaker)

Editor and Tech Correspondent

Bloomberg

Nate is an editor and tech correspondent for Bloomberg, based in London. For over a decade, he has particularly focused on the consumer technology sector, and the trends shaping the global industry. Previous to this, he was senior editor at Bloomberg Media and was head of digital editorial for Bloomberg.com in Europe, the Middle East and Africa. Nate has held numerous roles across the most respected titles in tech, including stints as editor of WIRED.co.uk, editor-in-chief of Ars Technica UK and senior editor at CBS-owned CNET. Nate launched his professional career as a journalist by founding a small tech and gaming website called TechMessage, which is now the name of his weekly technology podcast hosted at natelanxon.com.

Tania Boler

CEO and founder

Elvie

Tania is an internationally recognized womenhealth expert and has held leadership positions for various global NGOs and the United Nations. Passionate about challenging taboo womenissues, Tania founded Elvie in 2013, partnering with Alexander Asseily to create a global hub of connected health and lifestyle products for women.

Tania Boler

CEO and founder

Elvie

Tania is an internationally recognized womenhealth expert and has held leadership positions for various global NGOs and the United Nations. Passionate about challenging taboo womenissues, Tania founded Elvie in 2013, partnering with Alexander Asseily to create a global hub of connected health and lifestyle products for women.

- Details

- Category: Technology Today

Read more: Original text too long. Text can have up to 4,000 words.

Write comment (98 Comments)NASA and SpaceX have set a specific date and time target for their historic first astronaut launch aboard a private spacecraft from U.S. soil, with a planned date of May 27 and a target liftoff time of 4:32 PM EDT (1:32 PM PDT) from Kennedy Space Center, at SpaceXLaunch Complex 39A (LC-39). The mission had been previously announced to be tracking toward a mid to late-May launch time frame, but now we know exactly when the agency and SpaceX hope to launch astronauts Bob Behnken and Doug Hurley for this inaugural trip to the International Space Station.

The launch is the first crewed mission in NASACommercial Crew program, which seeks to return American launch capabilities to U.S. soil through private partnerships, with both SpaceX and Boeing taking part and developing their own separate launch vehicles and crew craft. SpaceX has taken all the steps necessary to get to this stage ahead of Boeing, and this flight, called Demo-2, while still technically part of the test program, will see NASAastronauts visit the space station for &an extended stay,& with a full duration yet to be determined.

This final test will validate each aspect of the Crew Dragon and Falcon 9 launch system, including the pad from which the rocket takes off, the operational facilities on the ground, orbital systems and astronaut procedures. Pending successful completion of all those elements, Crew Dragon should be set for full operational certification, after which time it can begin regularly scheduled service of delivering astronauts to and from the ISS.

For the mission, Crew Dragon will launch with Behnken and Hurley, then enter orbit and rendezvous with the ISS, which should occur around 24 hours after liftoff. The spacecraft is designed to dock fully autonomously with the station (and has done so on a previous occasion during an uncrewed demo mission), then Behnken and Hurley will disembark and join as members of the ISS crew, performing research on the orbital science platform.

The Crew Dragon flying this mission is designed to stay on orbit for around 110 days, but its actual length of stay will be decided by how ready the commercial crew mission to follow is at the time of launch. That Crew Dragon, which is the fully operational version, is designed for stays of at least 210 days, and the crew complement of four astronauts, including three from NASA and one from Japanspace agency, is already determined. If all goes well, it&ll happen sometime later this year.

Crew Dragon from Demo-2 will perform an automated undocking from the ISS with Behnken and Hurley on board when it is ready to leave, and then they&ll re-enter Earthatmosphere and have a controlled splashdown landing in the Atlantic Ocean, where a SpaceX ship will pick them up and bring them back to Florida.

Obviously, NASA and SpaceX are facing challenges, along with everyone else, with the global COVID-19 crisis ongoing, but the agency has taken extra precautions to ensure this mission continues, since NASA Administrator Jim Bridenstine notes that continued U.S. access to, and presence within the ISS is critical.

- Details

- Category: Technology Today

Read more: NASA and SpaceX established historic very first astronaut launch for Might 27

Write comment (96 Comments)Vox Media is making a number of cutbacks in response to the economic fallout from the COVID-19 pandemic.

In addition to Vox itself, the digital media company owns properties including Curbed, Eater, Recode, SB Nation and The Verge — and it acquired New York Magazine last year.

In a staff memo obtained by TechCrunch (and others), CEO Jim Bankoff outlined several cost-cutting measures but no outright layoffs.

The measures including furloughing 9% of employees from May 1 to July 31. Bankoff said this will include some employees in sales, sales support, production, events, IT and office operations, along with editorial staff at SB Nation and Curbed. He also said affected employees will retain their company health insurance during this period.

In addition, the company is freezing wages through the end of 2020, pausing its 401K match, reducing hours for 1% of employees and cutting salaries during the same three-month furlough period for employees making more than $130,000 per year — the cuts start at 15%, with Bankoff and Vox Media President Pam Wasserstein taking a 50% salary reduction.

In explaining the layoffs, Bankoff pointed to the broader economic collapse caused by the pandemic, with the dramatic reduction in ad spending, which has led many other media companies to announce layoffs and/or salary reductions.

Bankoff wrote:

We&ve already seen a decline in our business. Weakness in March, driven by the cancellations of SXSW and March Madness, the collapse of travel, sports and fashion-related advertising, and other factors led us to miss our revenue goals by several million dollars in the first quarter; the impact will be significantly greater in the second quarter. While expressing the severity of this decline, italso important to know that we will rebound. We don&t know when or to what extent a rebound will occur. I&d be overjoyed if it happened quickly, but we cannot bet our company on these hopes.

Update: The Vox Media Union has been tweeting in response to the news, painting the current plan as the result of negotiation:

While we appreciate Vox Media talking to us in good faith, we don&t agree with the companydecision to furlough employees — especially after hundreds of us told the company we were willing to take wider pay cuts to save all jobs. So we fought for strong protections. We won a guarantee of no layoffs, no additional furloughs, and no additional pay cuts through July 31, along with enhanced severance for any layoffs that occur in August-December. The company also agreed to reduce the number of furloughs.

- Details

- Category: Technology Today

Airbnb has ended its contracts with contingent workers early and postponed summer internships, Protocol reports. Contractors at Airbnb serve as property inspectors, home consultants and more.

Contractors will reportedly receive no less than two weeks& pay after receiving notice from their temp agencies.

Airbnb will also reportedly delay hiring undergraduate students until next year. TechCrunch has since heard from an incoming intern that he was notified yesterday and that henow scrambling to find a new internship.

Airbnb is not the only tech company to cancel internships amid the COVID-19 pandemic. In March, Yelp canceled its summer internship and TCNatasha Mascarenhas has since learned StubHub, Glassdoor, Funding Circle and Checkr have also canceled their respective internships.

These personnel changes come just one day after Airbnb secured a $1 billion loan.Earlier this month, Airbnb raised an additional $1 billion in debt and equity.

TechCrunch has reached out to Airbnb and will update this story if we hear back.

Additional reporting by Natasha Mascarenhas.

- Details

- Category: Technology Today

Read more: Airbnb reportedly gives up contractors as well as terminates summer season internships

Write comment (91 Comments)

One of the largest COVID-19 vaccine trials currently underway will have over 500 volunteers actively testing its solution by the middle of next month. Researchers at the University of Oxford have already secured that number of participants, including a representative sample of people between the ages of 18 to 55, for a large-scale randomized clinical early and mid-stage trial of its potential vaccine, which uses a harmless, modified virus to trigger an immune response that is also effective against the novel coronavirus.

The trial will divide a total of 510 participant sent five groups, with one group receiving a follow-up, booster shot of the vaccine after the original does. The technology behind the vaccine has already been used in developing about 10 different other treatments, but will require an approach that includes setting up different test groups in different countries to ensure representative results, since infection rates are varying greatly place to place with prevention measures in place, study lead Sarah Gilbert told Bloomberg.

The team behind the vaccine is also still seeking additional funding to help scale manufacturing, since it aims to begin producing it in volume following the six month period this human trial phase will span. The goal is to have mass production up and running by this fall, under the assumption that the trial proves the potential vaccine effective, with a final stage trial of 5,000 people and the potential to begin providing some doses for use by frontline healthcare workers by as early as September.

The Oxford trial is one of just a handful that have progressed to the human testing phase, but more are coming online all the time. Existing clinical human trials from Moderna and Inovio are underway in the U.S., and those have also expressed the potential for earlier access for emergency use prior to broad rollout following the initial clinical results.

Even if there is some availability by fall of some of these vaccine candidates (and that assumes they even prove effective), that doesn&t mean they&ll be broadly available: That will still require further testing, and scaling manufacturing, as well as working out distribution and administration & all processes that will add months of work. Already, however, the unprecedented nature of the COVID-19 pandemic has resulted in new efficiencies in the development process, and more could follow in these extraordinary times.

- Details

- Category: Technology Today

Page 954 of 1437

19

19