Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

A new federal aid package designed to provide economic relief to businesses still immobilized by the coronavirus just passed in the Senate.

The $484 billion in total aid passed after two weeks of negotiations between Republicans, who wanted to press additional small business funding forward without much reevaluation, and Democrats, who were eventually able to secure additional relief measures beyond the small business funding at the heart of the bill.

The focal point of the new legislation is the $310 billion it will allocate to the Paycheck Protection Program, a key feature of the first relief package. That program was beset by problems from the outset, with a huge portion of small business owners failing to secure the forgivable loans through banks even with prompt applications in the programearliest moments.

Within a few days of going live, it became clear the application process was plagued by issues, and its massive $349 billion pool of funds had already dried up. Some small business owners also reported that they couldn&t find a bank to accept their application, as some banks prioritized existing customers.

Among those issues: Some of the money was sucked dry by entities that a program for small businesses probably shouldn&t be helping out to begin with. Remarkably, even hedge funds, major restaurant chains and Harvard University cashed in on the loans under the existing terms, while most owners of actually small businesses were left high and dry.

Companies with fewer than 500 employees were eligible for the loans, which become forgivable if the money is put toward payroll by hiring back or retaining employees. The maximum loan under the PPP is 2.5 times a companyaverage monthly payroll, up to $10 million.

Out of the new $321 billion, $60 billion will go to smaller lenders and credit unions that can provide loans to small businesses that might not bank with major financial institutions. Other measures Democrats secured in the new legislation include an additional $75 billion for hospitals and $25 billion for a national COVID-19 testing strategy, funding that comes with a requirement that the Trump administration form a &strategic plan& for helping states with testing.

The interim bill does not include any funding for a vote by mail system — federal funds that some Democratic lawmakers and a bipartisan group of state election officials view as essential for conducting safe voting this fall. Additional funding to help adapt and administer the 2020 election is likely to be a big talking point in the next wave of relief legislation.

The latest relief bill, which President Trump has signaled he will sign, will now move to the House, where it is expected to pass on Thursday.

- Details

- Category: Technology Today

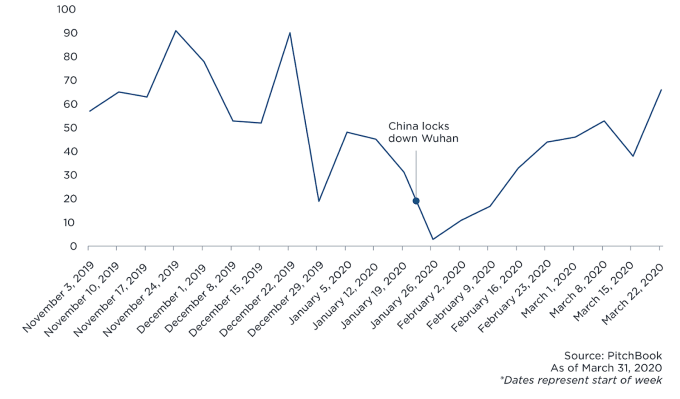

For the past month, VC investment pace seems to have slacked off in the U.S., but deal activities in China are picking up following a slowdown prompted by the COVID-19 outbreak.

According to PitchBook, &Chinese firms recorded 66 venture capital deals for the week ended March 28, the most of any week in 2020 and just below figures from the same time last year,& (although 2019 was a slow year). There is a natural lag between when deals are made and when they are announced, but still, there are some interesting trends that I couldn&t help noticing.

While many U.S.-based VCs haven&t had a chance to focus on new deals, recent investment trends coming out of China may indicate which shifts might persist after the crisis and what it could mean for the U.S. investor community.

Image Credits: PitchBook

- Details

- Category: Technology Today

Read more: Will China's coronavirus-related patterns form the future for American VCs

Write comment (92 Comments)Mattress company Casper is shutting down its European operations and laying off 78 people as it focuses on &achieving profitability,& according to a statement by the company. The layoff impacts 21% of its corporate workforce globally.

In the statement, the company said that it is winding down European operations to &concentrate on the strength of the North American business.& The action out will result in more than $10 million in annualized savings, per the company.

The company also noted that CasperCFO and COO, Gregory Macfarlane, will be departing from the company on May 15.

Casper said it will give impacted employees in both North America and Europe severance, extended medical coverage, career coaching and new job placement support.The company did not immediately return a request for comment.

In the months since itslackluster IPOandtroubled public market debut in February, the company has struggled amid the COVID-19 pandemic. Last month it announced it will shut down all retail locations and furlough all retail employees.

Ahead of going public, Casper hinted at some struggles. The company cut its valuation by more than 50% by lowering its expected price range from between $17 to $19 per share to between $12 and $13.

Casper was one of the recent tech unicorns to make it to the public market, and might be for a while given an increasingly tumultuous economic environment. Tech unicorns have not been immune to the massive number of layoffs seen around the world right now. GetAround, Knotel, Sonder, ZipRecruiter, TripActions and Bird are all among the second wave of unicorn layoffs.

As reported by Crunchbase News with data from layoffs.fyi, 46% of all reported layoffs for private companies come from unicorn companies. Roughly 36 private unicorn companies have laid off staff since the COVID-19 outbreak, according to the data.

Itworth remembering that amid these massive layoffs, it is likely that employees in satellite offices will likely be affected. Casper is a clear example of this, as the New York-based company cuts its Europe team.

The company is throwing up warning signs ahead of Q1 earnings, which it will report on May 21, 2020.

- Details

- Category: Technology Today

Read more: Casper winds down European operations and lays off 78 people

Write comment (99 Comments)There is no shortage of coverage about the sprawling entertainment industry. There is a shortage of coverage for die-hard fans of reality TV shows, according to Kate Ward and Lindsay Mannering.

That opening in the market is why the two — former colleagues at the womenwebsite Bustle, where Ward was the founding editor-in-chief and Mannering ultimately became the SVP of editorial strategy at Bustleparent company — decided to take the plunge In January and start their own company.

Called The Dipp, the nascent, Brooklyn-based media company describes itself as a &personalized subscription website for TVbiggest fans,& and the idea, says Ward, is to zero in on the &niche fandoms that are being created every day — especially now [that everyone is at home and online]. We want to focus on certain franchises that are underserved, then scale.&

They say they know what it takes. Both joined Bustle back in 2013 when it was itself a fledgling startup, and both say they helped grow the company on a variety of fronts, from writing, to organizing the site, to helping with PR and sales, to immersing themselves in its scaling strategy.

It was so exhilarating, says Ward, that when the company ballooned to 80 million unique monthly visitors across all its publications, the two found themselves missing those early days.

They also seemingly decided what from that experience they did not want to replicate, including to build a property thatsolely reliant on sponsored content and other advertising. (Like many other ad-driven media properties to grow quickly in recent years, Bustle has also been ratcheting back on staff dating back to last summer, with its most recent round of layoffs announced early this month.)

Of course, building a media property in the midst of a pandemic would seem to come with its own challenges. The Dipp was fortunate on the funding front; it just locked down $2.3 million in seed funding led by Defy Partners, helped by Wardprevious relationship with Defy co-founder Neil Sequeira, who was formerly a managing director with General Catalyst and who sat on the board of Bustle in that role.

On the other hand, its founders — who live several miles apart — can&t work together right now owing to the coronavirus.

Ita big change from the early days of Bustle when &we sat shoulder to shoulder together on a sofa,& acknowledges Ward, adding that the hardest part so far has been having to celebrate early milestones remotely. &Normally, something good happens and you go out to dinner or have a drink. Right now, itmore like, ‘We got a term sheet, yay!& over Gchat.& (Mannering sent Ward a bottle of champagne and Jell-O shots over the weekend, but it &doesn&t feel the same,& Ward says with a laugh.)

Luckily for both, hiring might not prove the same challenge as it might to other founders who are just getting a company off the ground, given that many journalists already work remotely. They also suggest they have an extensive network of people to tap given their own media backgrounds.

In fact, they insist that there are upsides to launching a new endeavor in these suddenly strange days.

Mannering notes, for example, that the two have more time to focus on what they are building, whereas before New York shut down, they were budgeting a lot of time for traveling and pitching — and spending a fair amount of each day on the subway.

Ward thinks the founders and VCs with whom they&ve talked have also been more earnest than they might have been six months ago, before the coronavirus struck the U.S. &Therethis sense that we&re all in this together now,& she says. &In the past, whereas there was a lot of puffing of chests and you might walk away thinking, ‘I hope I&ll be as good a founder as this person someday,& everyone is sort of leveling with each other, including about what pitfalls to look for.Just trying to get through [this pandemic] kind of grounds every conversation, so you&re really getting to know people in that first meeting.&

As for next steps, stay tuned, say the co-founders. The idea is to launch their content this fall, with a snazzy user interface, an accompanying weekly newsletter and, later, podcasts. The Dipp also plans to focus heavily on community, says Ward. Comments will be their first area of focus, but subscribers can also expect online discussions and ask-me-anything-style forums with individuals from the franchises that The Dipp readers want to know more about, she says.

Users will be able to sign up for a free trial to start; after that, says Ward, they&ll be charged a monthly fee for an all-access pass, including, most importantly, to a home page thatcustomized so members can see &only what you care about rather than rifling through shows and topics that don&t interest you in the least.&

Indeed, the secret sauce behind The Dipp will really be data, culled in part from social media, that informs which franchises and characters the outlet zooms into for its readers. As Ward notes, Bustle was early to recognize that what tastemakers like matters far less than whatplaying well with consumers.

As a result, Bustle knows what many women — including millennial moms — are searching to learn in much the same way that Netflix knows what its viewers prefer to watch.

Ita long way from here to there, but if The Dippplans work out, it will be an entertainment brand that knows better than most what its audience wants to read, too.

- Details

- Category: Technology Today

Swiggy is cutting about 1,000 jobs, most from its cloud kitchen division, as Indiatop food delivery startup scales back some of its businesses in response to the coronavirus pandemic that has drastically affected millions of firms.

In a statement, the Bangalore-based startup said it was &evaluating various means to stay nimble and focus on growth and profitability across our kitchens.&

&This will, unfortunately, have an impact on a certain number of kitchen staff who will be fully supported during this transition,& said the startup, which, according to an analysis on LinkedIn, employs about 12,000 people.

Swiggy did not reveal the number of people it was letting go, but a source familiar with the matter told TechCrunch that about 1,000 jobs were being cut. Indian news outlet Entrackr first reported the layoffs.

As the firm cuts its headcount, it is also looking to reduce its monthly burn rate to about $5 million, down from about $20 million it spends in winning customers currently, the source said, requesting anonymity as some of these matters remain private.

Swiggy — which has raised $1.42 billion to date, including$156 million as part of an ongoing Series I roundthis year — competes with Ant Financial-backed Zomato, which is also in talks to raise about $500 million by mid-May, Deepinder Goyal, the co-founder and chief executive of the Gurgaon-based startup, told TechCrunch last week.

Both the startups spend nearly the same amount of money in discounts and other incentives to sustain their customers and win new patrons. Indiafood delivery market, valued at $4 billion (by research firm RedSeer), has become a duopoly as FoodPanda, owned by Ola, made a major strategic shift in recent years and Uber sold its Indian Uber Eats business to Zomato.

Swiggy and Zomato have, however, struggled to cut costs in fear that they might lose customers. And those fears are well founded.

Anand Lunia, a VC at India Quotient, said that the food delivery firms have little choice but to keep subsidizing the cost of food items on their platform, as otherwise most of their customers can&t afford them.

The lockdown that New Delhi ordered last month has created new challenges for both Swiggy and Zomato. Both the startups are now seeing fewer than a million orders placed on their platforms, down from nearly 3 million they were handling before the outbreak.

In the last year, both the startups have attempted to expand into new categories in search of additional revenue sources. Swiggy has expanded and doubled down on cloud kitchens, which allows its restaurant partners to launch in more locations with not as much investment.

Late last year, Swiggy executives said they had established 1,000 cloud kitchens for itsrestaurant partners in the country — more than any of its local rivals. The startup said it had invested in more than a million square feet of real estate space across 14 cities in the country in the last two years.

In the wake of pandemic, both Swiggy and Zomato have also started delivering grocery items to customers.

- Details

- Category: Technology Today

Read more: Indian food delivery startup Swiggy is cutting about 1,000 jobs

Write comment (96 Comments)

We reviewed the Lhmzniy A9 not so long ago, and it remains one of the most promising laptops from China we’ve encountered in 2020. It comes with Windows 10 Pro, 16GB of RAM in dual channel, a webcam cover and a tiny charger - not to mention a premium finish that doesn't seem to match its affordable price tag.

Fast forward to April and a slightly

- Details

- Category: Technology Today

Read more: Below's the most affordable Core i5 laptop computer now

Write comment (98 Comments)Page 914 of 1439

11

11